Meet some of the team

Karen is the Senior Wealth Coach at Wealth Maximiser, bringing her expertise to the team since August 2023. She is a qualified and experienced financial adviser, providing financial advice for over 18 years. She also founded Women Talking Finance in 2019, focusing on financial literacy and empowerment through delving into people’s money psychology to understand their

habits and attitudes towards money. She holds a Bachelor of Accounting, an Advanced Diploma in Financial Planning and CFP. She holds director positions on boards for two profit-for-purpose organisations. She is a regular financial commentator appearing regularly on 5AA radio, podcasts and news media.

We’re on a mission to simplify and

amplify your Wealth

We want to help you simplify and amplify your wealth with Wealth Maximiser. Our tailored, actionable

financial guidance is a cost effective alternative to traditional product based financial advice, that aims to

enhance your wealth, financial wellbeing and achieve your key goals.

How we help you simplify

Goal setting, goal getting

Let us help you define your most important financial goals through our free goal setting tool.

Wealth health at your fingertips

We’ll help you understand your current Wealth Health score and how you can improve it.

Wealth components condensed

We combine financial wellbeing and wealth building components into your personalised financial strategy

How we help you amplify

A wealth roadmap built just for you

Pick from three tailored strategies for your best fit and complete the actions included to start building wealth now!

Investing education

No matter where you are in your investing journey, we can help – from when and what to invest in to growing your portfolio.

Resources and Guidance

Get regular updates with tips and tools, from personal emails to monthly group coaching, we help you stay finance fit!

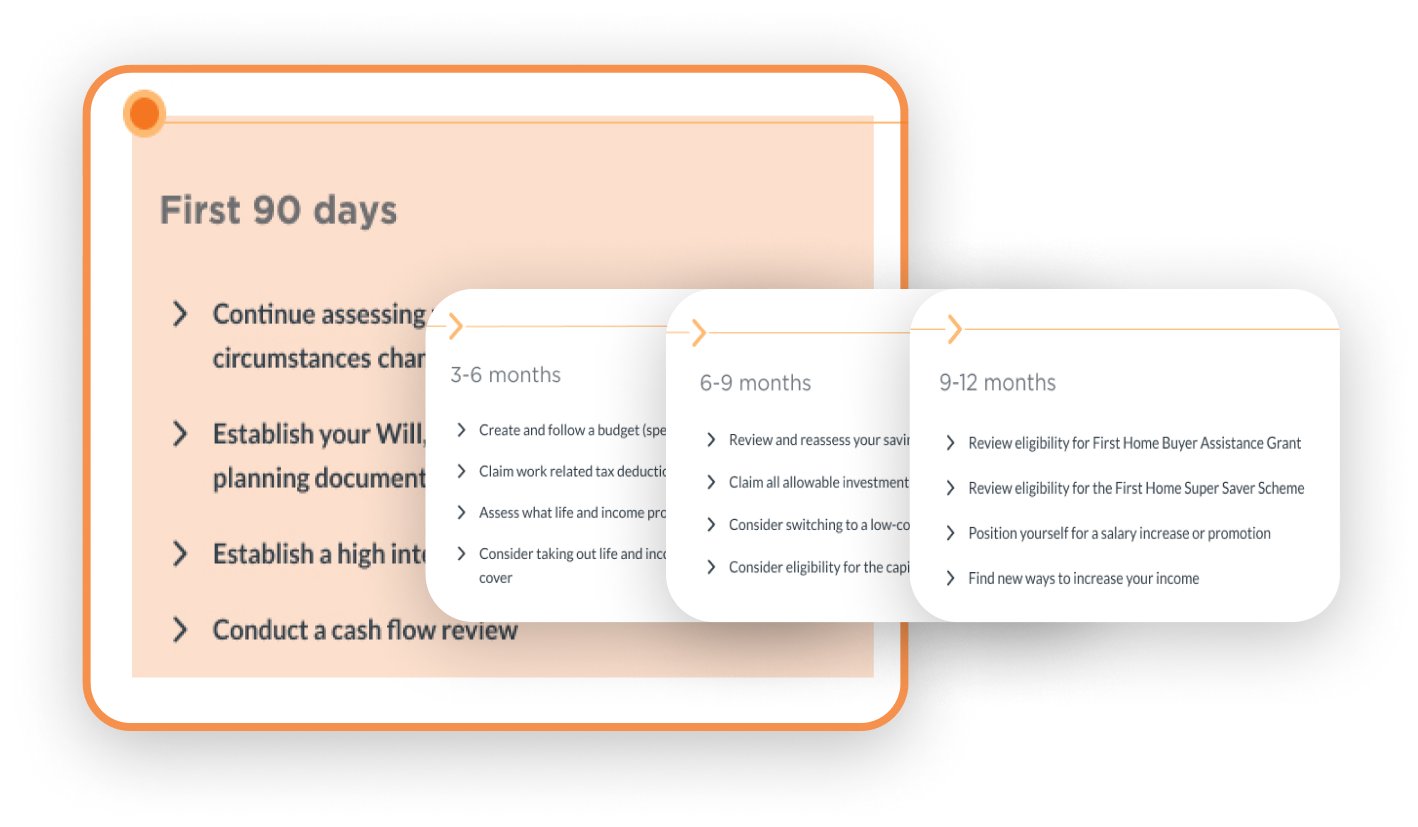

Tailored Financial Plan

Your Wealth Maximiser journey truly begins once you select your wealth strategy. After this you will receive your personalised financial plan with actionable, manageable steps, to help you improve your financial wellbeing and achieve your financial goals.

See exerts of a financial plan hereWealth Maximiser is a NobleOak initiative.

A new and innovative approach backed by history and scale. NobleOak has a long history that can be traced back to benevolent societies in Australia. It commenced in 1877 as the Druids Friendly Society of NSW, protecting families and loved ones. Our life insurance business is award winning. We have brought our values of nobility, simplicity and genuine support into Wealth Maximiser. However Wealth Maximiser is operated by NobleOak Services Limited, which is a separate financial services business to NobleOak Life Limited’s Life Insurance business.

Wealth Maximiser does not include recommendations for NobleOak’s Life Insurance products.

Please see our Terms and Conditions, Privacy Policy and FSG for more detail.

Please also see our Whistleblower policy and our Modern Slavery statement.

Google Review

Book your no obligation

complimentary

25 minute Goal Setting session with a Wealth Coach

Book a free session