“How much money do I need to retire?”

This is easily the most common question I’ve gotten in my time as a Financial Adviser / Wealth Coach. Everyone wants to hear some sort of golden number, but the real answer is – it depends!

Usually, the answer to this question lies in another question: ‘How much do you want to be able to spend each year once you are retired?’

That might also be a hard question to answer. Most people don’t know how much they spend each day – let alone how much they spend in an entire year. A common benchmark is between $70,000 to $80,000 p.a. Given the average salary in Australia after tax is around $75,0001, this is probably a safe figure and usually won’t be too different to what you were taking home whilst working.

However, to give some extra guidance, I’ll usually ask people to think about the following:

- Do you think you will spend more or less than what you are spending now?

- Do you have planned vacations or significant holidays?

- Will you eventually downsize?

- Do you want to help out your children financially?

In my experience, most people overestimate their retirement costs, and spend less on a day-to-day basis once they’ve stopped work.

The other important factor is that your spending will probably slow down as you get to your later retirement years. Once you’ve ticked off those bucket list trips, and slow down a little as you age, many retirees spend less in their later years compared to their first few years. So often it’s a moving target.

What is a “Comfortable Retirement”?

The ASFA Retirement Standard States that a “comfortable” lifestyle in retirement for couples is approximately $72,148 p.a.2 It also states a “modest” lifestyle is $46,995 p.a.

Considering the maximum Centrelink Age Pension for couples is currently $43,7533, you need to at least be partially self-funded in retirement to achieve even just a Modest lifestyle.

Given that many people want to travel in their early retirement, you might want to increase the comfortable retirement figure to $80,000 p.a. This would provide a good buffer and means that you’ve accounted for an extra comfortable retirement.

Let’s work on how much you would need to achieve $80,000 p.a. in retirement without any reliance on the Age Pension.

To figure this out, we work on a ‘capital drawdown’ basis – where you think about your retirement income in terms of a percentage of your investment assets. So, say for example, you had a million dollars total, a retirement income $80,000 would require you to withdraw 8.00% p.a. from your investments.

Most people’s retirement assets will be largely made up of Super. You might have an investment property or share portfolio as well, and that would definitely help. The good thing about if you’re getting all your income from Super, is that it will usually be tax free in retirement.

Ideally, you want to be in a position where the net return of your assets is at least equal to or greater than your capital drawdown.

This can mean that your retirement income will be essentially self-sustaining. It means that you’re not drawing down on your assets, but just using the returns each year to meet your needs. This will mean that you can worry far less about your money running out and will also mean you can potentially leave behind a legacy for your estate or family.

A comfortable retirement example:

If we go back to the previous example, we can assume that the couple in question has most of their $1M held within their Super. Remember that we’re not including the family home, because you can’t easily draw down on or produce an income from this asset.

The average 10 year returns for a Balanced Super portfolio has been 6.80% (2023)4. Actual returns will depend on your fund, and obviously there will be good and bad years. But in this situation, an annual return of 6.80% is less than an annual drawdown of 8.00%, which means their assets would slowly deplete over time.

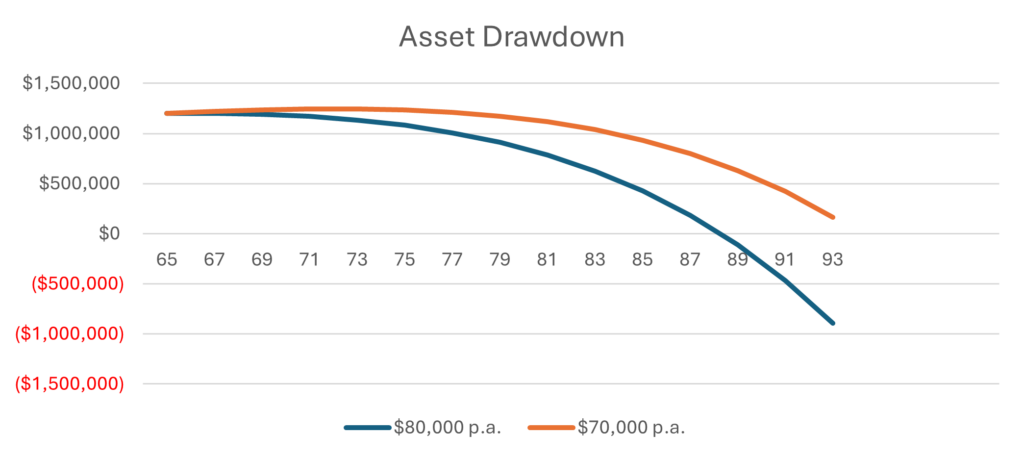

In this very simple example (and assuming inflation of 3% p.a.), the couple in question would run out of Super by around Age 82 (average life expectancy in Australia is currently 83)5. This isn’t ideal if they live past 82 – but remember we aren’t including any Age Pension, which would make a huge difference and probably allow them to sustain that income for their lifetime.

Also – recall what we said about retirement income needs decreasing each year – which probably offsets a fair bit of inflation. The example just goes to show that whilst ever your drawdown is greater than the income, there is the risk of your assets depleting over time.

In the same scenario above, imagine that the couple had each saved an extra $100,000 over the years in their super. This would lead to net assets of $1.2M, with the annual drawdown of $80,000 p.a. being 6.67%, slightly lower than the returns of 6.80%. This leads to a hugely different outcome, where assets would last until at least the age of 88 without any Age Pension.

Reducing your income target obviously makes a huge difference. Below you can see the difference in longevity for an income of$80,000 p.a. versus $70,000 p.a.

Whilst these figures are hopefully useful, in reality, the Age Pension will be a crucial piece of the Retirement Income puzzle. ASFA estimates that couples would only need $690,000 in Super at retirement to fund a comfortable lifestyle.2

Also, inflation, actual investment returns and decreasing retirement expenditure would all factor in, and the above scenarios are a both conservative ‘worst case’ scenarios. If a member of a couple passes away in that time, it’s very likely that retirement expenses would decrease which would make the funds last even longer. Also, if your assets are running out, some couples may decide to downsize their home as they might find the larger home they raised their kids in gets a bit harder to manage as they age.

So in a nutshell, here are the three things you need to do to ensure you are all set for a great retirement:

STEP 1: Figure out how much you’re going to want to spend each year (eg. Extra comfortable, comfortable versus modest).

STEP 2: Figure out your expected investment return based upon your risk tolerance.

STEP 3: Aim to build your assets to a point where your average investment returns exceed your desired income.

Wealth Maximiser provides financial projections that use your current financial details to provide an analysis of whether you will be able to afford your desired retirement. Running through these projections with one of our Wealth Coaches can be a great way to put your mind at ease as to whether your money will last the distance.

Your Wealth Coach will also provide you with tailored strategies that will help improve your position, and you will be able to see how much longer your funds would last if you implemented some of the strategies.

Book a free session with one of our Coaches to learn more about your retirement, and how to best optimise your position ahead of your retirement years.

Blog written by Peter McDonagh

- https://www.seek.com.au/career-advice/article/a-guide-to-the-average-salary-in-australia

- https://www.superannuation.asn.au/resources/retirement-standard/

- https://www.servicesaustralia.gov.au/how-much-age-pension-you-can-get?context=22526

- https://www.smh.com.au/money/super-and-retirement/these-top-super-funds-delivered-double-digit-returns-in-2023-20240118-p5ey7s.html

- https://datacommons.org/place/country/AUS?utm_medium=explore&mprop=lifeExpectancy&popt=Person&hl=en

This page may contain both personal and general financial product advice. Any general financial product advice contained in this page is general in nature and does not take into consideration your objectives, financial situation or needs. Before acting on it, you should consider the appropriateness of the advice having regard to your objectives, financial situation and needs. In particular, you should always read the relevant Product Disclosure Statement or other offer documents prior to acquiring any financial product. Any personal financial advice will be set out in a Statement of Advice. Wealth Maximiser is operated by NobleOak Services Limited ACN 112 981 718 AFSL 286798.